how is a reit taxed

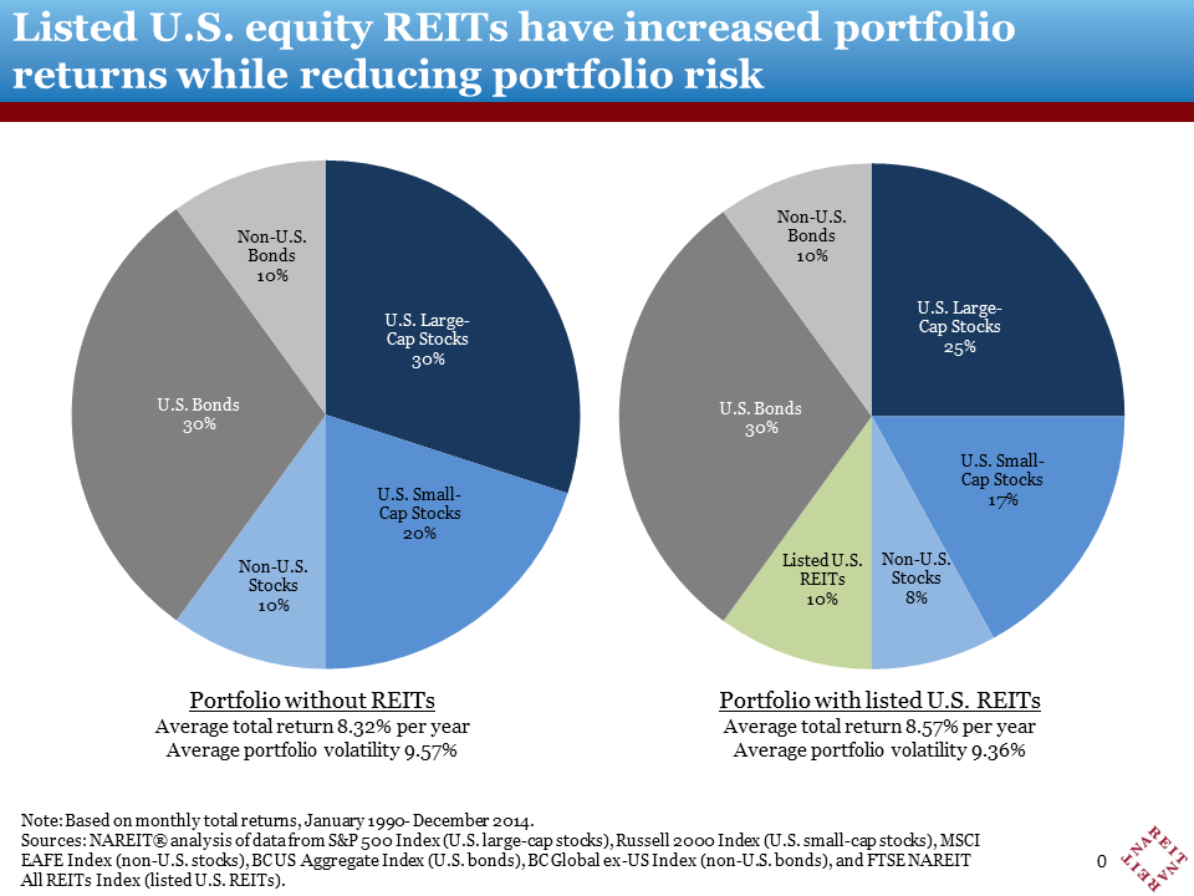

A real estate investment trust or REIT is essentially a mutual fund for real estate. Nontaxable Return on Capital Taxed as a capital gain There was one huge change in taxation for REIT investors as well as a part of Tax Reform.

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

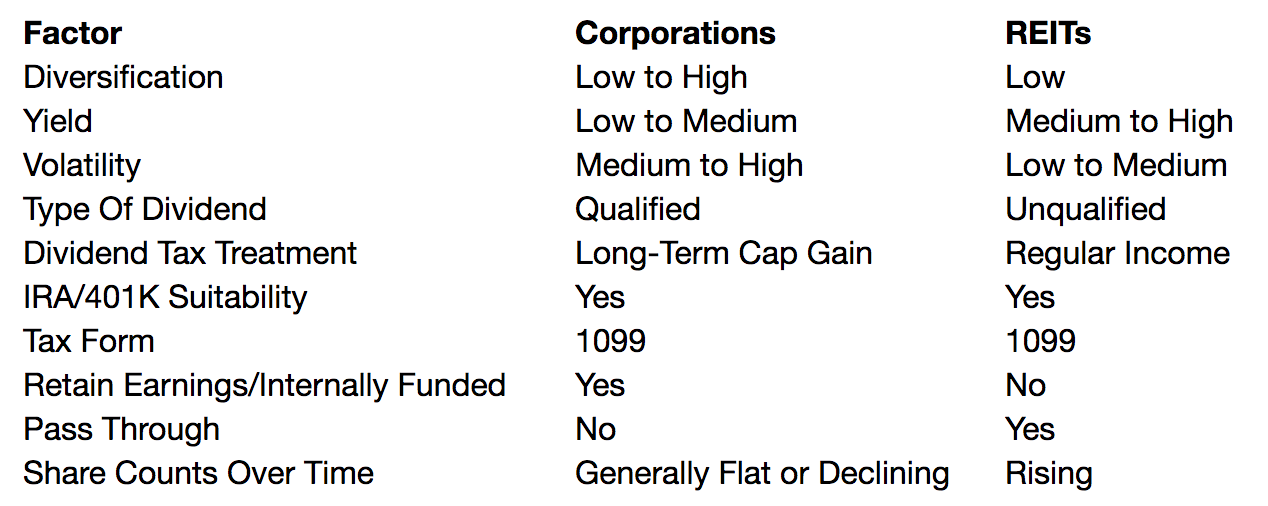

REITs provide income through dividends but REIT dividends are usually taxed at a higher rate than stock dividends.

. The Internal Revenue Service IRS treats the sale of interests in a REIT in the same manner as the sale of other capital assets such as stocks and bonds. While finding a tax friendly retirement account it is. Thus a REIT is able to avoid.

These dividends arent taxed. REIT taxation is a special case. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment.

As a part of the bill there is a. In exchange for meeting certain requirements -- in particular paying at least 90 of their taxable income to shareholders as dividends -- REITs pay. In 2022 ordinary income tax rates range from 10 to 37.

Taxes are deferred until you sell your shares of the REIT and are either long- or short-term depending on. If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20. A REIT is an entity that would be taxed as a corporation were it not for its special REIT status.

Dividends - Taxed as ordinary income not a. Second your REIT can also provide you with. While owning a REIT in an open account will result in unfavorable tax rates an IRA Roth IRA or 401k can be much more tax friendly.

You will need to pay tax on any capital gains earned through the sale of properties in your REIT ETF. Pass-through income is taxed as ordinary income which are generally the highest tax brackets that taxpayers pay. The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax.

Each REIT must provide investors with the following allocations for each dividend and distribution to ensure property tax treatment. As the name suggests the trust invests in real estate related investments. How is REIT income taxed.

Your capital gains are taxed at 0 15 or 20 depending on your level of income. Generally most people pay a 15 dividend tax rate if youre in any of the middle tax brackets. To meet the definition of a REIT the bulk of its assets and income must come from real estate.

How is a REIT Taxed. You should also be prepared for the market swings that come. This requirement means REITs typically dont pay corpora See more.

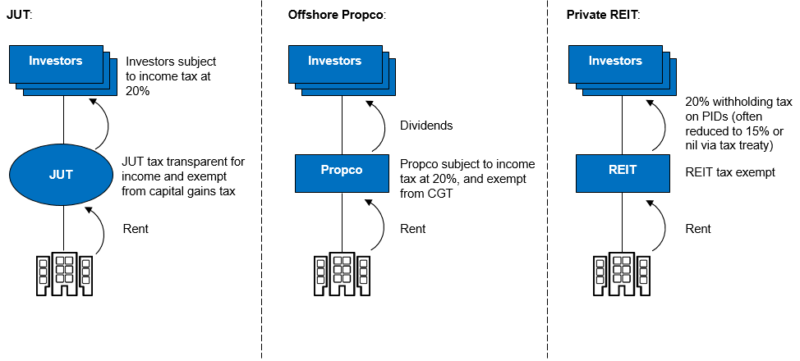

Purchases of REIT shares will generally be subject to stamp duty or stamp duty reserve tax at the rate of 05 compared to a top rate of stamp duty land tax of 5 for. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. If you have a REIT though its considered pass-through business income for the.

A REIT calculates taxable income much the same as other domestic corporationshowever it is entitled to a dividends-paid deduction. Rather they reduce your cost basis in the investment. In addition it must pay 90 of its taxable income to shareholders.

Real Estate Investment Trust Reit How They Work And How To Invest

Should You Invest In Reits Ally

How To Form Reit Forming A Real Estate Investment Trust Nareit

The Most Important Metrics For Reit Investing

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Lesson 5 Other Managed Products Flashcards Quizlet

Reit Taxation Untangling The Knots

Real Estate Investment Trusts Tax Implications For Investors

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

Congress Looks At Reit Tax Exemption Wsj

Real Estate Investment Trusts Reits What Are Reits

Rethinking The Tax Revenue Effect Of Reit Taxation Florida Tax Review

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha